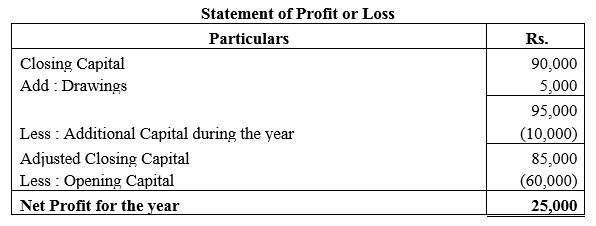

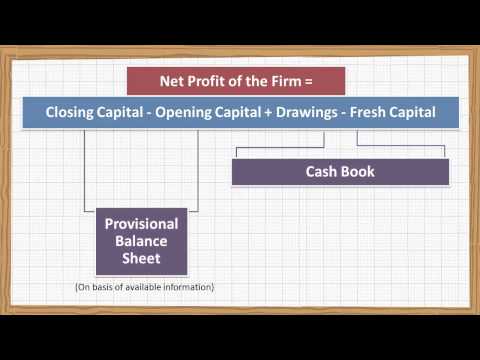

76+ pages how to calculate interest on capital in single entry system 6mb. Cash received or paid fromto business debtors or creditors are merely written on the bills issued or received. How to calculate interest on capital in single entry systemA complete question of single entry systemIncrease in net worth method complete question. The following method is used for the calculation of profit or loss under single entry system. Read also capital and learn more manual guide in how to calculate interest on capital in single entry system Capital at the end Drawing Fresh capital -Opening.

Interest on capital is an expense for the business and is added to the capital of the proprietor thereby increasing his total capital in the business. The double effect of interest on Drawings is.

Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions Salary Payroll Template Good Essay

| Title: Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions Salary Payroll Template Good Essay |

| Format: ePub Book |

| Number of Pages: 257 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: May 2021 |

| File Size: 1.1mb |

| Read Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions Salary Payroll Template Good Essay |

|

None of the above.

A Provide interest on capital 5 pa. In a simple single entry system cash book is maintained along with the personal accounts and these are maintained as per double entry system of bookkeeping. Simple Single Entry System. How will find the interest on capital in single entry system - 2619822. Calculation of interest on capital. Capital at the end Drawing Fresh capital -Opening capital.

Conversion Method Easy Steps To Convert From Single Entry To Double Entry Accounting

| Title: Conversion Method Easy Steps To Convert From Single Entry To Double Entry Accounting |

| Format: eBook |

| Number of Pages: 267 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: April 2021 |

| File Size: 2.6mb |

| Read Conversion Method Easy Steps To Convert From Single Entry To Double Entry Accounting |

|

Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs

| Title: Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs |

| Format: ePub Book |

| Number of Pages: 176 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: January 2019 |

| File Size: 810kb |

| Read Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs |

|

Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs

| Title: Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs |

| Format: ePub Book |

| Number of Pages: 256 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: August 2018 |

| File Size: 1.1mb |

| Read Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs |

|

Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions

| Title: Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

| Format: PDF |

| Number of Pages: 218 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: March 2021 |

| File Size: 1.9mb |

| Read Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

|

Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions

| Title: Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

| Format: eBook |

| Number of Pages: 234 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: June 2019 |

| File Size: 1.4mb |

| Read Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

|

Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions

| Title: Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

| Format: ePub Book |

| Number of Pages: 190 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: January 2020 |

| File Size: 1.2mb |

| Read Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

|

Statement Of Affairs For Calculation Of Profit Or Loss Under Single Entry

| Title: Statement Of Affairs For Calculation Of Profit Or Loss Under Single Entry |

| Format: ePub Book |

| Number of Pages: 343 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: April 2018 |

| File Size: 2.8mb |

| Read Statement Of Affairs For Calculation Of Profit Or Loss Under Single Entry |

|

Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs

| Title: Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs |

| Format: ePub Book |

| Number of Pages: 189 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: December 2021 |

| File Size: 1.5mb |

| Read Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs |

|

Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions

| Title: Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

| Format: eBook |

| Number of Pages: 323 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: October 2020 |

| File Size: 800kb |

| Read Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

|

Single Entry System Accounting Example Format Advantage Problems

| Title: Single Entry System Accounting Example Format Advantage Problems |

| Format: ePub Book |

| Number of Pages: 262 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: May 2021 |

| File Size: 2.6mb |

| Read Single Entry System Accounting Example Format Advantage Problems |

|

Single Entry Vs Double Entry Accounting Systems Examples Pared Bookkeeg And Accounting Double Entry Accounting

| Title: Single Entry Vs Double Entry Accounting Systems Examples Pared Bookkeeg And Accounting Double Entry Accounting |

| Format: ePub Book |

| Number of Pages: 334 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: June 2018 |

| File Size: 1.6mb |

| Read Single Entry Vs Double Entry Accounting Systems Examples Pared Bookkeeg And Accounting Double Entry Accounting |

|

Capital at the end Drawing Fresh capital -Opening capital. Simple Single Entry System. Interest on Mannans capital 80000 x 5100 4000.

Here is all you have to to know about how to calculate interest on capital in single entry system Calculation of Profit or Loss under Single Entry System. Normally Interest on capital is calculated at the end of the financial year and make a provision to make it payable to the contributorSince the capital is the owners money it is added to his money and business owes that money to him. It is a gain to the business and loss to the proprietor. Conversion method easy steps to convert from single entry to double entry accounting calculation of profit or loss under single entry system notes videos qa and tests other other accounting for inplete records kullabs ts grewal accountancy class 11 solutions chapter 16 accounts from inplete records single entry system ncert solutions ts grewal accountancy class 11 solutions chapter 16 accounts from inplete records single entry system ncert solutions single entry vs double entry accounting systems examples pared bookkeeg and accounting double entry accounting ts grewal accountancy class 11 solutions chapter 16 accounts from inplete records single entry system ncert solutions Amount contributed in excess of the other partner.

0 Comments