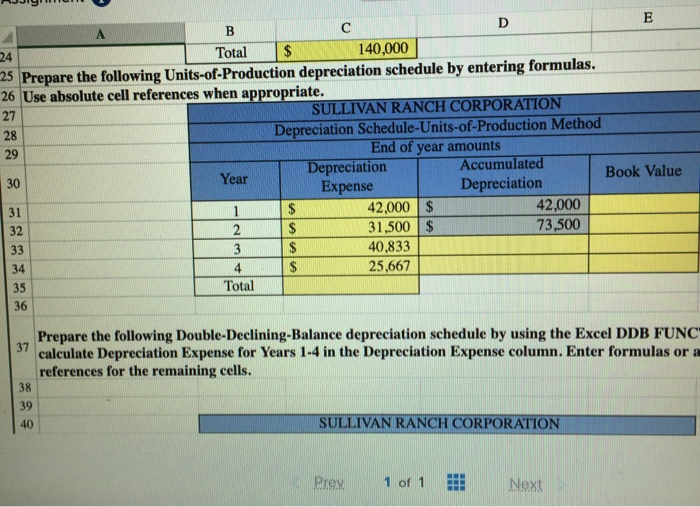

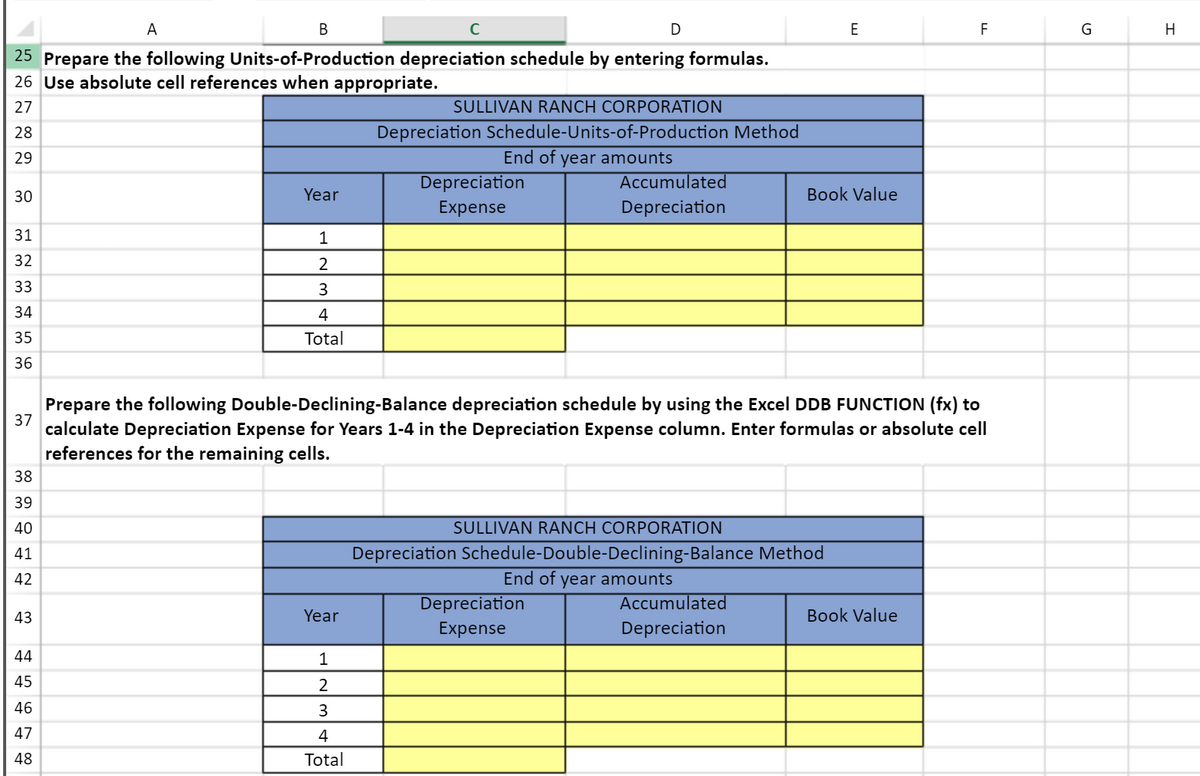

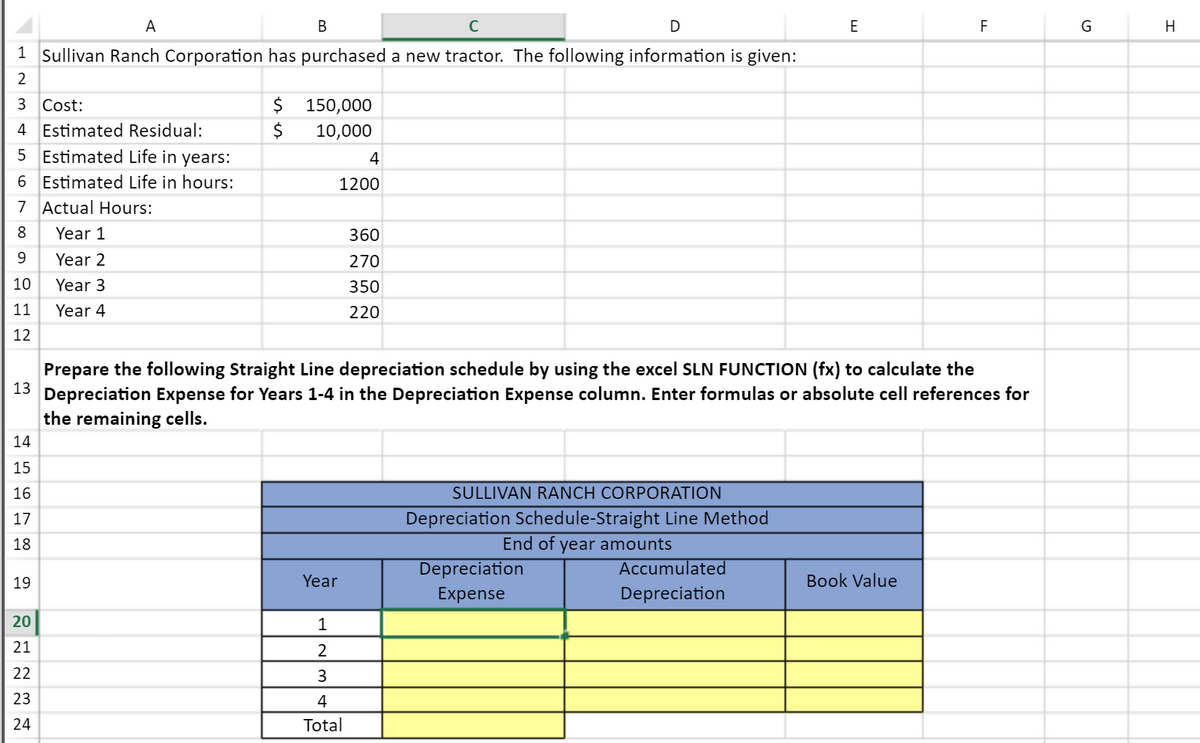

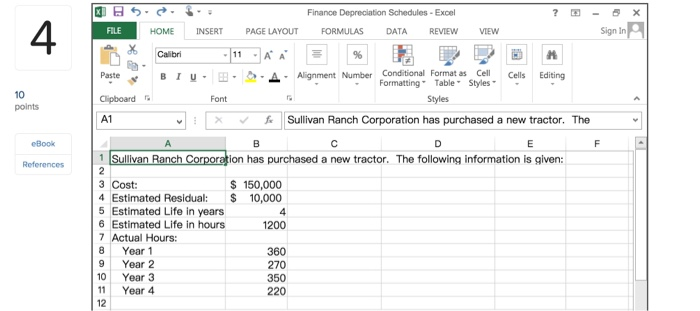

17+ pages sullivan ranch corporation has purchased a new tractor 2.3mb. 1 Year 1 360 Year 2 270 Year 3 350 Year 4 220 Prepare the subjoined right Line diminution register by using the achieve LN FUNCTION fx to calcul. Sullivan Ranch Corporation has purchased a new tractor. 10000 Estimated Life in years. Check also: ranch and learn more manual guide in sullivan ranch corporation has purchased a new tractor Sullivan Ranch Corporation has purchased a new tractor.

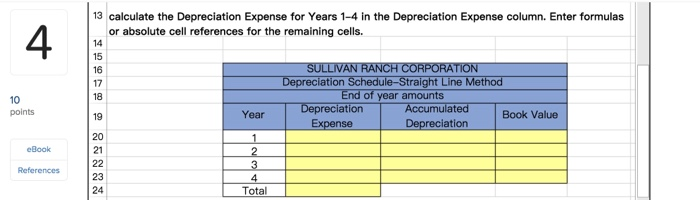

3 Year 1 360 3 Year 2 270 0 Year 3 350 Year 4 220 1 Prepare the following Straight line depreciation schedule by using the excel SLN FUNCTION fx to calculate the 3 Depreciation. Sullivan ranch corporation has purchased a new tractor and has provided thr information realted to thr purchase.

Excel Sullivan Ranch Corporation Has Purchased A Chegg

| Title: Excel Sullivan Ranch Corporation Has Purchased A Chegg |

| Format: ePub Book |

| Number of Pages: 298 pages Sullivan Ranch Corporation Has Purchased A New Tractor |

| Publication Date: March 2019 |

| File Size: 1.7mb |

| Read Excel Sullivan Ranch Corporation Has Purchased A Chegg |

|

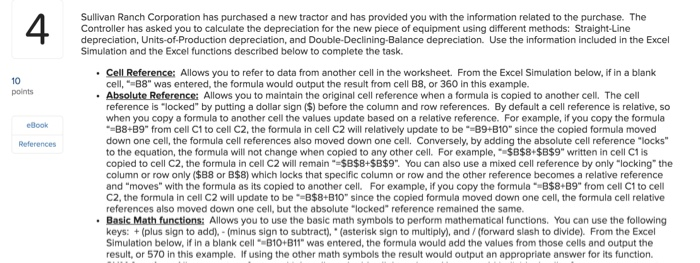

Sullivan Ranch Corporation has purchased a new tractor.

1 Year 1 360 Year 2 270 Year 3 350 Year 4 220 Prepare the following straight Line depreciation schedule by using the excel LN FUNCTION fx to calcul. The Controller Has Asked You To Calculate The Depreciation For The New Piece Of Equipment Using Different Methods. 10000 Estimated Life in years. The following information is given. S 150000 10000 Cost. Straight-Line Depreciation Units-of-Production Depreciation And Double-Declining-Balance Depreciation.

Sullivan Ranch Corporation Has Purchased A New Chegg

| Title: Sullivan Ranch Corporation Has Purchased A New Chegg |

| Format: ePub Book |

| Number of Pages: 233 pages Sullivan Ranch Corporation Has Purchased A New Tractor |

| Publication Date: January 2017 |

| File Size: 2.6mb |

| Read Sullivan Ranch Corporation Has Purchased A New Chegg |

|

Solved 10 00 Points 1 Prepare Depreciation Schedules Using 1 Answer Transtutors

| Title: Solved 10 00 Points 1 Prepare Depreciation Schedules Using 1 Answer Transtutors |

| Format: PDF |

| Number of Pages: 327 pages Sullivan Ranch Corporation Has Purchased A New Tractor |

| Publication Date: May 2018 |

| File Size: 1.5mb |

| Read Solved 10 00 Points 1 Prepare Depreciation Schedules Using 1 Answer Transtutors |

|

Answered 1 Sullivan Ranch Corporation Has Bartle

| Title: Answered 1 Sullivan Ranch Corporation Has Bartle |

| Format: PDF |

| Number of Pages: 330 pages Sullivan Ranch Corporation Has Purchased A New Tractor |

| Publication Date: December 2020 |

| File Size: 2.3mb |

| Read Answered 1 Sullivan Ranch Corporation Has Bartle |

|

Solved Sullivan Ranch Corporation Has Purchased A New Tractor And Has Provided You With The Information Related To The Purchase The Controller Has Course Hero

| Title: Solved Sullivan Ranch Corporation Has Purchased A New Tractor And Has Provided You With The Information Related To The Purchase The Controller Has Course Hero |

| Format: eBook |

| Number of Pages: 269 pages Sullivan Ranch Corporation Has Purchased A New Tractor |

| Publication Date: June 2021 |

| File Size: 2.8mb |

| Read Solved Sullivan Ranch Corporation Has Purchased A New Tractor And Has Provided You With The Information Related To The Purchase The Controller Has Course Hero |

|

Answered 1 Sullivan Ranch Corporation Has Bartle

| Title: Answered 1 Sullivan Ranch Corporation Has Bartle |

| Format: eBook |

| Number of Pages: 274 pages Sullivan Ranch Corporation Has Purchased A New Tractor |

| Publication Date: August 2019 |

| File Size: 2.2mb |

| Read Answered 1 Sullivan Ranch Corporation Has Bartle |

|

4 Sullivan Ranch Corporation Has Purchased A New Chegg

| Title: 4 Sullivan Ranch Corporation Has Purchased A New Chegg |

| Format: eBook |

| Number of Pages: 227 pages Sullivan Ranch Corporation Has Purchased A New Tractor |

| Publication Date: October 2021 |

| File Size: 1.5mb |

| Read 4 Sullivan Ranch Corporation Has Purchased A New Chegg |

|

4 Sullivan Ranch Corporation Has Purchased A New Chegg

| Title: 4 Sullivan Ranch Corporation Has Purchased A New Chegg |

| Format: eBook |

| Number of Pages: 207 pages Sullivan Ranch Corporation Has Purchased A New Tractor |

| Publication Date: February 2017 |

| File Size: 1.7mb |

| Read 4 Sullivan Ranch Corporation Has Purchased A New Chegg |

|

Sullivan Ranch Corporation Has Purchased A New Chegg

| Title: Sullivan Ranch Corporation Has Purchased A New Chegg |

| Format: eBook |

| Number of Pages: 225 pages Sullivan Ranch Corporation Has Purchased A New Tractor |

| Publication Date: October 2017 |

| File Size: 1.6mb |

| Read Sullivan Ranch Corporation Has Purchased A New Chegg |

|

4 Sullivan Ranch Corporation Has Purchased A New Chegg

| Title: 4 Sullivan Ranch Corporation Has Purchased A New Chegg |

| Format: eBook |

| Number of Pages: 147 pages Sullivan Ranch Corporation Has Purchased A New Tractor |

| Publication Date: February 2018 |

| File Size: 1.7mb |

| Read 4 Sullivan Ranch Corporation Has Purchased A New Chegg |

|

Claas Xerion 5000 Black Traktoren Landmaschinen Traktor

| Title: Claas Xerion 5000 Black Traktoren Landmaschinen Traktor |

| Format: PDF |

| Number of Pages: 281 pages Sullivan Ranch Corporation Has Purchased A New Tractor |

| Publication Date: May 2021 |

| File Size: 800kb |

| Read Claas Xerion 5000 Black Traktoren Landmaschinen Traktor |

|

Sullivan Ranch Corporation Has Purchased A New Chegg

| Title: Sullivan Ranch Corporation Has Purchased A New Chegg |

| Format: eBook |

| Number of Pages: 336 pages Sullivan Ranch Corporation Has Purchased A New Tractor |

| Publication Date: October 2020 |

| File Size: 1.6mb |

| Read Sullivan Ranch Corporation Has Purchased A New Chegg |

|

The following information is given. 10000 Estimated Life in years. Straight-Line depreciation Units-of-Production depreciation and Double-Declining-Balance depreciation.

Here is all you need to learn about sullivan ranch corporation has purchased a new tractor 10000 Estimated Life in years. 10000 Estimated Life in years. The following information is given. 4 sullivan ranch corporation has purchased a new chegg answered 1 sullivan ranch corporation has bartle 4 sullivan ranch corporation has purchased a new chegg claas xerion 5000 black traktoren landmaschinen traktor solved 10 00 points 1 prepare depreciation schedules using 1 answer transtutors solved sullivan ranch corporation has purchased a new tractor and has provided you with the information related to the purchase the controller has course hero 3 Year 1 360 3 Year 2 270 0 Year 3 350 Year 4 220 1 Prepare the following Straight line depreciation schedule by using the excel SLN FUNCTION fx to calculate the 3 Depreciation.

0 Comments